March 15, 2022

Today, we are super excited to launch Anywaypay!

Anywaypay is the first platform to unify all your payment methods into one link. There are hundreds of payment service providers and methods around the world, so we’ve been working tirelessly to solve one of today’s biggest questions: How do you want to pay? This is especially true for students, freelancers, businesses and virtually anyone involved in any financial interaction.

The global digital payments market was valued at around $111B in 2023 at a compound annual growth rate of 15.5%. By 2027, the market is expected to reach about $200B according to Research and Markets. At Anywaypay, we have the vision to solve the fragmentation problem once and for all by simplifying the way we handle digital payments.

The Core Problem: Platform Fragmentation

Picture this: A freelancer working with global clients, each using a different payment platform, or a group of friends unable to split a dinner bill because they all use different apps. These scenarios are not just hypothetical but everyday realities for millions. This is where Anywaypay steps in, offering a unified payment link that consolidates various digital wallets and payment methods.

A study from Baymard Institute suggested that the average online shopping cart abandonment rate was about 70%. One of the reasons for high abandonment rates is the lack of preferred payment methods, indicating that when consumers cannot pay how they want, they often don't pay at all.

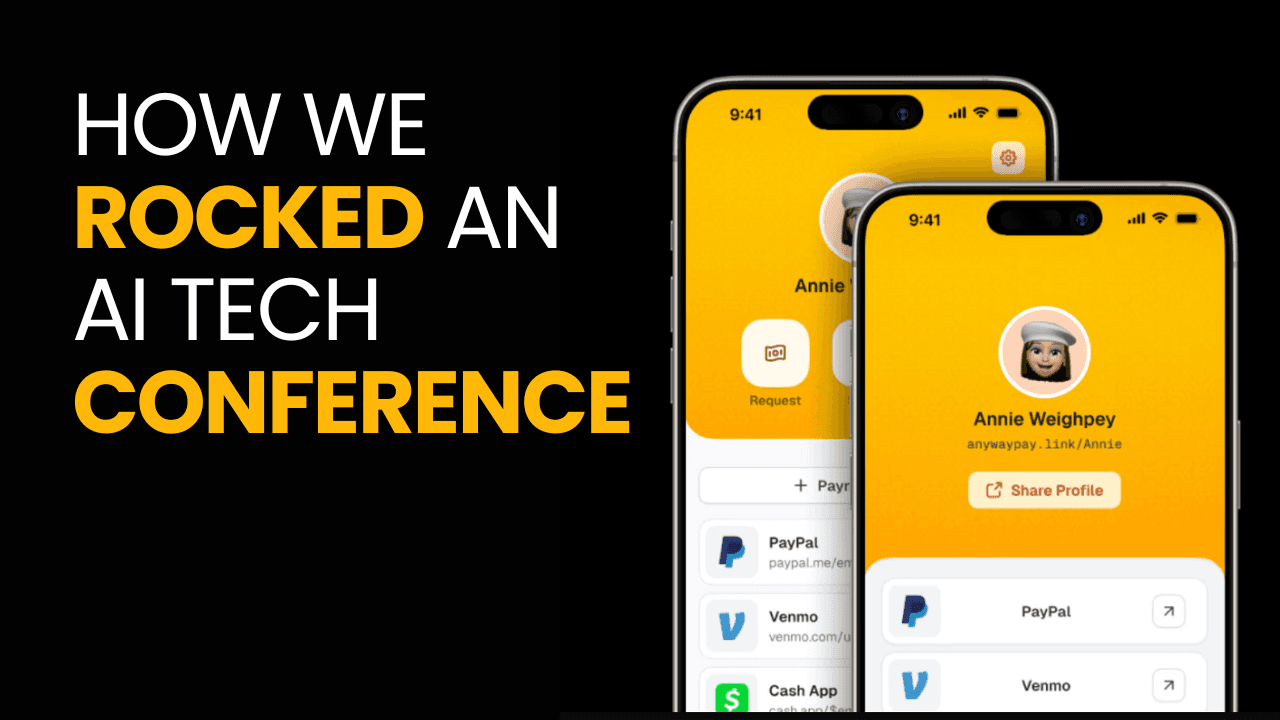

The Solution: Anywaypay Link

The concept is brilliantly simple yet effective. Users create an Anywaypay account and add their preferred payment methods. They then share their unique Anywaypay link for transactions, allowing payers to choose from a range of options. This approach not only simplifies transactions but also broadens accessibility.

How It Works

Users add their various payment links to their Anywaypay account.

They share their Anywaypay link with anyone who needs to pay them.

Payers can choose from the list of payment options available on the receiver's Anywaypay link.

The Future of Digital Payments

As digital transactions continue to grow, the need for a unified payment solution becomes increasingly important. Anywaypay isn’t just solving a present-day problem; it's paving the way for a future where financial transactions, regardless of the platform, are unified, simplified, and accessible to everyone. At Anywaypay we are not just addressing current needs but also shaping the future of financial interactions. Providing a unified link for various payment platforms is only the beginning.

We are building the next generation of digital payments, something set to ease the burden of managing multiple accounts and eliminate the barriers of platform incompatibility. What we are working on is a platform that can handle transactions between any payment method, so users won’t even have to add their payment methods to their unified link. Our ambition is to handle the transaction end-to-end no matter what the platform or the payment method, so users can just pay in a click of a button.

No more back and forth, no more confusion. This approach eliminates the need to juggle multiple platforms or ask others to sign up for new services.

Beyond Payments: Financial Independence

Anywaypay is more than just a payment solution; it's a mission to end awkward conversations around billing and payments and to facilitate instant payments. Whether you're a student, freelancer, or fall anywhere in between, Anywaypay is designed to make your financial interactions as smooth and natural as possible.

Making people more financially independent is our core mission. Financial independence goes beyond just having enough money. It embodies the empowerment and freedom to make informed choices about one's finances. This involves understanding and effectively managing various aspects of personal finance, including budgeting, saving, investing, and navigating diverse payment platforms.

At Anywaypay, we believe that achieving financial independence starts with financial literacy. It means equipping individuals with the knowledge and skills necessary to make wise financial decisions. This encompasses understanding how to manage debt, the importance of saving for the future, and the know-how to invest wisely. Financial literacy is not just about accumulating wealth; it’s about creating a sustainable and secure financial future.

The simplicity of Anywaypay encourages users to engage more actively with their finances, fostering a greater sense of control and confidence. Being financially independent means having the autonomy to make decisions that best suit one's financial goals without being hindered by a lack of understanding or access to necessary resources. Through enhancing financial literacy and simplifying the payment process, Anywaypay empowers individuals to reach this level of independence, ensuring that managing finances is not a task, but an empowering aspect of everyday life.

Join us!

Join us in our journey to make financial transactions easy for everyone! Download Anywaypay today or become an ambassador!

We are excited to get your feedback and we are also opening a direct line of communication with you: we want to hear about the most awkward or annoying situation you’ve had while trying to make a transaction. It could be at a restaurant, paying your rent, sending money to friends and family, and of course any professional transactions. Send your story by email or video to payments@anywaypay.com and maybe we’ll post it on our social media!